Investing in Real Estate Wholesaling: An Overview

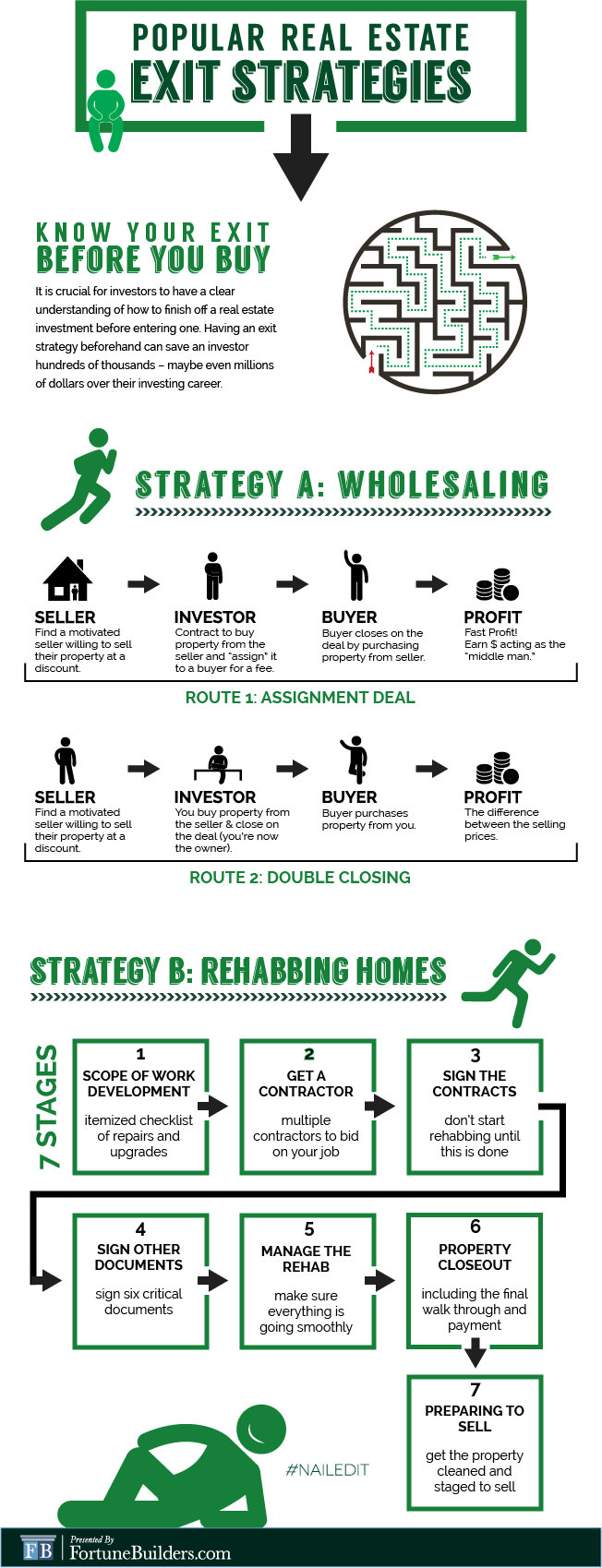

Real estate wholesaling investing offers newcomers a low-cost entry into property investment. The method requires finding distressed properties under contract and assigning purchase rights for a profit. This model sidesteps mortgage hurdles and landlord duties by acting as a middleman. This strategy develops expertise in property valuation, persuasive communication, and contract management. The fast deal cycles in wholesaling can accelerate cash flow compared to traditional buy-and-hold methods. A strong buyer pipeline ensures contract transfers occur without delays. Consistency and integrity in negotiations foster long-term relationships and business momentum.

Why Choose Real Estate Wholesaling Investing

One significant benefit is the minimal capital required to start wholesaling, making it accessible to most investors. Wholesaling provides a fast turnaround, often resulting in profits within weeks instead of years. The learning curve in wholesaling imparts critical real estate skills applicable to other investment strategies. Wholesalers are not burdened by ongoing repair costs or rental vacancies. Wholesaling fosters relationship building with agents, attorneys, and investors, expanding professional networks.

Profits from assignments can be reinvested into bigger projects. Consistent assignment fees help streamline your financial projections and expense management. Wholesalers can maintain liquidity, avoiding cash flow constraints common in traditional buy-and-hold strategies. Taxes on single-event profits from contract assignments tend to be more straightforward than ongoing rental taxation. Joining experienced investor circles provides invaluable insights and exclusive lead sources. Leveraging online platforms and automated systems boosts your ability to capture and nurture leads. Utilizing expert-led resources strengthens your wholesaling skills and industry awareness.

To learn more about investing in real estate wholesaling, visit: how to start wholesaling

Essential Tools and Platforms

An integrated CRM organizes contacts, tracks communications, and prompts timely outreach to each prospect. Lead-generation software can scrape public records and online listings to uncover motivated sellers quickly. Built-in calculators break down after-repair value, renovation budgets, and wholesale margins in seconds. Electronic signing tools allow sellers and buyers to finalize documents instantly from any device. Email and SMS sequences tailored to seller profiles drive engagement and increase response rates. Digital title services offer transparency and speed, ensuring every document is accounted for before funding. Networking platforms and investor forums connect you with cash buyers eager for new deals, shortening your time to assignment.

The synergy of CRM, analytics, and marketing platforms creates a repeatable system that fuels sustainable growth.

How to Launch Your Wholesaling Venture

Start with thorough market research, analyzing comparable sales and emerging growth areas within your region. Compile a list of motivated seller leads through direct mail, bandit signs, and online advertising campaigns. Draft an assignable contract with the proper clauses and have it validated by a licensed attorney. Rehearse negotiation dialogues with a mentor to sharpen your persuasion and rapport-building techniques. Collect contact information from lenders, rehabbers, and rental investors to form your buyer pool. Automate lead responses and drip campaigns so that no prospect goes unattended. Finally, make your first offer on a well-researched deal, track your metrics, and iterate your process based on real-world results.

Typical Mistakes in Wholesaling and Their Solutions

Using rough or outdated comp data often erodes your profit margin—validate figures with recent, local comparables. Ignoring renovation budgets can turn a profitable contract into a loss—obtain accurate repair quotes upfront. Failing to build a robust buyer’s list can leave contracts stranded—continually grow and update your investor network. Inconsistent outreach lets prospects go cold—set up scheduled texts and emails to stay top-of-mind. Neglecting legal review of your contract templates can expose you to risk—always consult a real estate attorney. Overextending yourself by juggling too many deals too soon can lead to operational burnout—scale gradually. Ignoring market shifts and economic indicators can render your strategies obsolete—stay informed and adapt accordingly.

Final Thoughts on Investing in Real Estate Wholesaling

For newcomers, wholesaling contracts provides a streamlined path to real estate profits and industry know-how. Honing expertise in identifying opportunities, calculating profits, and closing assignments sets you apart in the market. Integrating digital solutions for data management, deal modeling, and outreach accelerates your growth trajectory. Continuous education, ethical practice, and network expansion fuel long-term credibility and deal flow. Begin with manageable deals, refine your approach, and funnel earnings back into expanding your pipeline. By staying disciplined and adaptable, wholesaling can evolve into a powerful pillar of your real estate endeavors.

Embrace the journey, leverage the resources at how does real estate wholesaling work, and watch your wholesaling success unfold.